If you are from a different country please reach out to us so we can prioritize. Vamshi Vangapally Dec Once you have your form , you can attach this with your tax returns or provide it to your tax preparer to file your taxes. All in one place Having all your crypto trades in one place can gives a fresh perspective on what strategies are working best. Also, you can export to TaxAct format , which is generally supported by lots of software used by accountants to file taxes. How does the app do so much automation? This would make the Fair Market Value of 0.

Bitcoin taxation basics

As a result, the proper calculation and correct reporting of taxes on Bitcoin gains has become important for crypto traders. This has raised questions about the rules of cryptocurrency taxation and how to calculate tax rates on Bitcoin trading, mining and purchasing. This article covers the fundamentals of Bitcoin taxes and how to report them to the IRS. According to the IRS, Bitcoin and other cryptocurrencies are classified as property. So all the general tax principles applicable to property transactions apply to transactions using virtual currency as. First of all you should understand if you even fall under the tax regulations and if you have to report to the IRS. The IRS uses the term taxable event — a situation when you have to report on your transaction activity:.

What is a capital gain? What about capital losses?

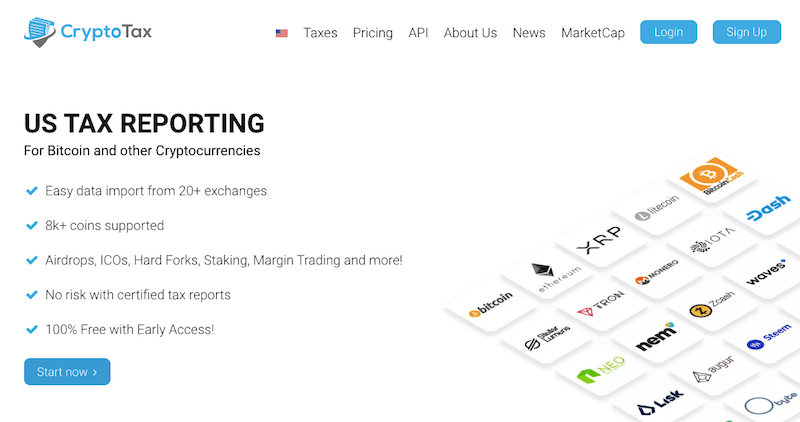

Tax is a cryptocurrency tool that helps in calculating gains, importing trade, simplifying preparation, and reporting of taxes. Initially, it was nearly impossible for high-level crypto traders to calculate their taxable trade incomes since it would take a lot of time especially if done manually. Tax seeks to eliminate this crypto tax problem through the crypto taxation services it provides. Traders are required to create an account to begin using the platform. Once the account creation process is completed, traders will have access to the free account, which is also the default account. The account is compatible with all the crypto assets in the market, includes 25 trades per report, and supports the FIFO Calculation mode as well as the manual trade imports.

Bitcoin Taxes — The Fundamentals

As a result, the proper calculation and correct reporting of taxes on Bitcoin gains has become important for crypto traders. This has raised questions about the rules of cryptocurrency taxation and how to calculate tax rates on Bitcoin trading, free way to calculate taxes for bitcoin and purchasing.

This article covers the fundamentals of Bitcoin taxes and how to report them to the IRS. According to the IRS, Bitcoin and other cryptocurrencies are classified as property.

So all the general tax principles applicable to property transactions apply calculatf transactions using virtual currency as. First of all you should understand if you even fall under the tax regulations and if you have to report to the IRS. The IRS uses the term taxable event — a situation when you have to report on your transaction activity:. Ok, now you need to calculate your Cost Basis, which is how much money you spent on purchasing gitcoin property.

For cryptocurrencies it is the purchase price plus brokerage, transaction and other fees. The formula of Cost Basis is simple:. Then you sell Bitcoins and need to calculate your gain or loss. For mining, the Fair Market Value is the price of coins when you have successfully mined a digital currency. That means. One more step, you have to calculate how long you owned crypto before free way to calculate taxes for bitcoin it. Your Bitcoin tax rate depends on. There are bitxoin term and long term gains:.

Long-term gains: If you are mining Bitcoins as a self-employed person your income is subject to the self-employment tax. The self-employment tax is The rate consists of two parts: In the Schedule D you report your capital gains for any type of property like cars, stocks and cryptocurrencies. The is used to detail each Bitcoin trade and the gains you received on each trade. You should sum up the gains at the end of the and then transfer this sum into the Schedule D.

How does it work? Please note that this article is for informative purpose and contains general information of Tax rules. We recommend you to read an official IRS guidance and confer with your tax consultant. Bitcoin taxation basics According to the IRS, Bitcoin and other cryptocurrencies are classified as property.

Learn your Bitcoin tax rate One more step, you have to calculate how long you owned crypto before selling it. There are short term and long term gains: If you hold BTC for one year or less — you cor short-term gains If you hold BTC for more than one year — you got long-term gains The taxes depend on your annual income, your status and how long you held your coins.

How to calculate Bitcoin taxes?

Cryptocurrency Tax in 5 Minutes — What are Taxable Events ?

Calculate the capital gain/loss

We use Google authentification services to stay protected. All in one place Having all your crypto trades in one place can gives a fresh perspective on what strategies are working best. How to Report Cryptocurrency on Taxes: This article dives into the specifics behind reporting your crypto transactions on your taxes. Every week! Though we try to automate and butcoin it easy for you to import and consolidate transactions, there could be some which could need a manual entry to align things better. Howard Marks Nov We use an AI technique called inferential logic in combination with some smart programming so the app gets more intelligent as you categorize more data.

Comments

Post a Comment