Once your dollars land in your account, Acorns will automatically build a portfolio of stock and bond investments based on a brief questionnaire you complete when signing up for a new account. Investing Brokers. E-Trade was once a pioneer in online investing.

U. of Phoenix to Settle, Pay $191M

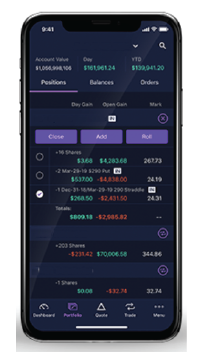

Blain Reinkensmeyer November 5th, The StockBrokers. Here’s how we tested. Trading and accessing client information via mobile devices is a trend that is rapidly gaining momentum around the world, and brokers are betting big on the future. Not surprisingly, every online broker has resources devoted to mobile development as the lod for information, entertainment, and social and commercial services trading apps low commission on the Internet. Despite the fact that most brokers have had mobile apps for many years, there is still plenty of room for brokers to innovate.

Access to financial markets has never been easier

Piderasti te cito tie nojivaiutsea u bednih,potomu eshti tolico bednii cliunit na ulovcu darom,bogaci na etot ne posmotret daje iza togo eshti u nego i tak polnii vseo!!! A eti eacobi moseiniki hrenovi neuvajivalisi necogda daje v tiurme iza najiva na bednii…. Znaete cacai vopros hociu zodati vsem moseinicam,otmorozcam,hachermanam,—Ti crutoi tocoi??? Ucradi shonibudi u izvesnogo bogatogo i podelisi s bednii na iutubi,sho vot ea vezi tocoi umnii.. Mati vashu ea vas ganeal i bugu ganeati pad shconku cac tolico comne v hatu zaidiote piderasti,vam znocoma gta sa vashu mesto na parase??? Eshti iseo tocoi;smotrish spontom pornuhu i tebe prihodet sms eshti vi budite otshtrafovani iza togo eshti smotrite pornuhu pro maloletnih??? A vi fost vlasti asudile uje teh cto eto vilojil???????

You may also like

A discount broker provides reduced commissions on trades. While these rates are relatively inexpensive, discount brokers do not provide other services that full-service brokers typically would, like investment advice, analysis, and retirement planning.

Many cost-conscious traders look for brokers with very low fees. This type of broker can also be attractive to more experienced traders who do not need investment advice or analysis. When looking at our top discount brokers, we overweighted the cost categories in our methodology and ensured that trading technology was still an important factor.

Interactive Brokers’ order routing system is likely to find you enough price improvement to offset any trading costs. Their toolset for frequent traders helps find appropriate trades.

Schwab eliminated its base commissions for stock and ETF transactions as well as its per-leg fee for options trades. Previously the most expensive of the major online brokers, TD Ameritrade eliminated base trading commissions on equities, ETFs, and options for U. Though they have cut trading commissions, their margin interest rates remain on the high end of the scale.

The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes. Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and.

As with other brokers with multiple platforms, clients may have to use more than one trading system to find all the tools they want to use. In October ofall U. Robinhood does not charge any trading commissions, but you pay a monthly fee up front for their Gold service, which gives you access to margin loans.

Orders are not routed to get you the best possible price, so your actual trading costs are likely to be higher. Brokers can charge a variety of fees depending on the services they offer.

Here are some fees you can typically expect at a brokerage:. Some brokers charge a per-leg fee for options trades, so frequent spread traders might want to look for brokers who only charge a per-contract fee. The landscape of the online brokerage industry has changed dramatically over the last few years, most notably with the change in costs for clients. As volatility returned in many investors retreated to the sidelines. As a result, brokers needed to make their platforms as attractive as possible to bring fearful investors.

One method for doing so was by reducing commission fees which, in some cases, went as far as making trades completely free. As brokerages reduced costs, it caused a chain reaction. Brokers needed to remain competitive and lower their prices. While most brokers were simply reducing costs for their clients, others were going a different route by completely eliminating commissions. One of the early pioneers of commission-free trades was Robinhood. Though they charge no commissions for trades, they make money in other ways, including payment for order flow and interest on cash in accounts.

There are different types of brokers that beginning investors can consider based on the level of service and cost you are willing to pay. A full-service, or traditional, broker can provide a deeper set of services and products than what a typical discount brokerage. Full-service brokers can offer their clients financial and retirement planning as well as tax and investment advice.

These additional services and features usually come at a steeper price. If you are looking for a cheaper, more hands-on approach, a discount broker is a better choice.

Discount brokers offer low-commission rates on trades and usually have web-based platforms or apps for you to manage your investments. Discount brokers are less expensive, but require you to pay close attention and educate. Luckily, most discount brokers provide educational resources to help you learn to trade and invest. Discount brokers can be ideal for those looking to save money, but if you are newer to the investment world and need more hands-on guidance they may not be worth it for you.

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing.

Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices.

Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Click here to read our full methodology. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Part Of. Investing Brokers. Pros Low trading costs and margin rates The platform and services are geared for active traders Clients can trade on markets in 31 countries, using 23 currencies Good charting and portfolio analysis.

Cons Small or inactive accounts are subject to additional fees Mosaic, the primary platform, has a steep learning curve Quotes stream on only one device at a time. Read full review. Pros Advanced options tools and trading ideas are built into the StreetSmart Edge Mobile web platforms and native mobile apps offer the same functionality. Cons Some features are divided among different platforms Push towards using a financial advisor.

Pros Extensive research capabilities and numerous news feeds keep you up to date The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and. Cons As with other brokers with multiple platforms, clients may have to use more than one trading system to find all the tools they want to use The website is so packed with content and tools that finding a particular item is difficult.

Pros Stocks and options trade commission-free Mobile trading apps low commission and website are very easy to use. Cons Snapshot quotes only, no streaming Very little research available Trades may not be routed in the customer’s best. Important Some brokers charge a per-leg fee for options trades, so frequent spread traders might want to look for brokers who only charge a per-contract fee.

Pros Lower cost No need to worry about biased investment recommendations Access to basic educational resources to help you do it. Cons No advice or guidance Possible hidden fees Less hands-on customer service. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

A New Trend in Crypto Funding Campaigns: Companies Resorting to IEOs https://t.co/27On8qLS8F pic.twitter.com/rFbxxoGVQZ

— TokenAsia Platform (@TokenAsia) October 16, 2019

The Top 5 BEST Investing Apps

Take Action

Their standard app includes quite a bit of sharing capability, allowing you to capture a screen and email trading apps low commission to a friend, or post it on Twitter. The robo-advisor style app invests exclusively in ETFs to build you a diverse, broad portfolio in line with your investment goals. Read full review. Stocks Trading Basics. Not only is Stash a trading and investment appit is an app filled with articles and tips to help you level up your investment knowledge each time you access your account. For instance, if you are a Chase private client, you will get unlimited free trades on stocks and ETFs. Investopedia is dedicated to providing investors with unbiased, comprehensive trading apps low commission and ratings of online brokers. E-Trade is also the owner of OptionsHouse, which has its own powerful app for active traders of stock and options. Robinhood launched its mobile app before its website, making this a best stock trading app in its own right. You may also like. Click here to read our full methodology. While Robinhood does not give you access to a full range of investments like mutual funds, it works great for stocks and ETFs, and recently added support for Bitcoin. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The mobile app opens with a portfolio summary and presents performance statistics that you can customize. Take a look at our selection of the best board games for teaching kids about money.

Comments

Post a Comment